Many lenders decide to hold partial payments in an account until the rest of it is received.

MORTGAGE CALCULATOR WITH EXTRA PAYMENTS BIWEEKLY FULL

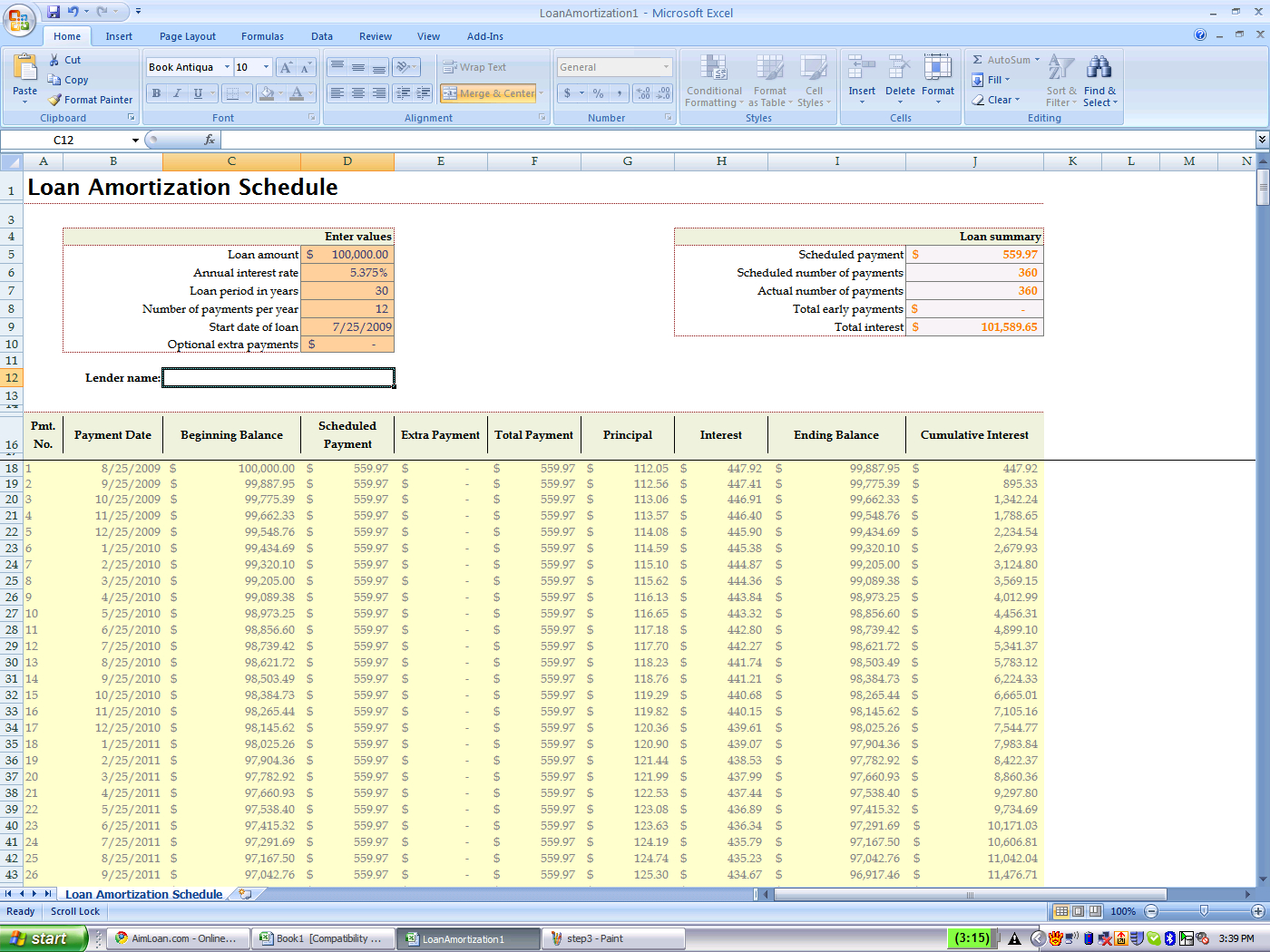

If the lender waits until the next payment has been received before crediting it to the loan's principal, the homeowner will not see the full benefit. In order for the homeowner to build equity in their home at a faster pace, the homeowner must have a lender that will credit half of the monthly payment immediately. Use our bi-weekly payment calculator to see how much you will save.

The homeowner would have to earn over $42,000 before taxes in order to net that much money. Paying one-half of the regular monthly mortgage bi-weekly makes the interest $97,215, which is a savings of $30,329. This also includes a $100,000 principal for a grand total of $227,544. Since the homeowner is reducing the amount of the loan balance quicker, they are also reducing the amount of interest charged over the life of the loan.Ī 30 year mortgage for $100,000 at a rate of 6.5% means the homeowner will pay $127,544 in interest throughout the life of the loan. That extra payment goes toward the principal of the loan. With the bi-weekly mortgage plan each year, one additional mortgage payment is made. Tens of thousands of dollars can be saved by making bi-weekly mortgage payments and enables the homeowner to pay off the mortgage almost eight years early with a savings of 23% of 30% of total interest costs. How the homeowner makes their mortgage payments can save a lot of money over the life of the loan.

0 kommentar(er)

0 kommentar(er)